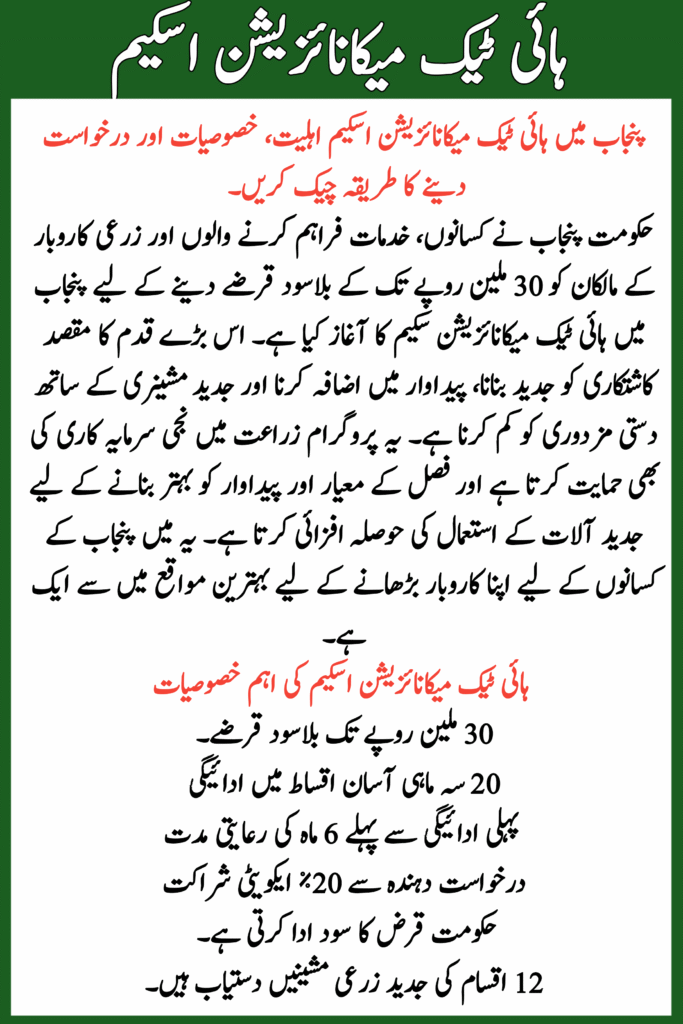

The Government of Punjab has launched the High-Tech Mechanization Scheme in Punjab to give interest-free loans up to PKR 30 million to farmers, service providers, and agri-business owners. This big step aims to modernize farming, increase productivity, and reduce manual labor with advanced machinery. This program also supports private investment in agriculture and encourages the use of modern tools to improve crop quality and yield. It is one of the top opportunities in 2025 for farmers in Punjab to grow their business.

Read More: PAVE Portal Login

Table of Contents

Purpose of the High-Tech Mechanization Scheme

Agriculture is the backbone of Punjab’s economy, but many farmers still use old methods. The High-Tech Mechanization Scheme helps farmers adopt advanced machines for cultivation, harvesting, and post-harvest work. The scheme ensures timely harvesting, reduces crop losses, and gives easy access to expensive machines through bank financing.

Key Features of the High Tech Mechanization Scheme

- Interest-free loans up to PKR 30 million

- Repayment in 20 easy quarterly installments

- 6-month grace period before the first payment

- 20% equity contribution from the applicant

- Government pays the loan interest

- 12 types of modern agricultural machines available.

Read More: Apna Plot Apna Ghar Scheme

Loan Features Summary

| Feature | Details |

| Loan Amount | Up to PKR 30 million |

| Equity Requirement | 20% of machine cost |

| Repayment Period | 5 years |

| Installments | 20 quarterly payments |

| Grace Period | 6 months |

| Loan Type | Interest-free (Govt bears interest) |

Eligibility Criteria for the High Tech Mechanization Scheme

To apply for the scheme, the applicant must:

- Be a resident of Punjab

- Be between 21 to 65 years of age

- Have a valid CNIC and registered mobile number

- Have a clean credit history

- Be willing to pay 20% equity upfront

- Be able to repay quarterly installments

- Agree not to sell the machinery for 5 years

Additional Requirements:

- Farmers must own at least 5 acres of land

- Service Providers must be registered with the Agriculture Department

- Entrepreneurs must have a valid NTN number

Eligibility Requirements

| Category | Requirement |

| Age Limit | 21 to 65 years |

| Land Ownership (Farmer) | Minimum 5 acres |

| Documents | CNIC, NTN (for Entrepreneurs), Service Provider Registration |

| Credit History | Must be clean |

| Equity Contribution | 20% of machinery cost |

Application Process for High-Tech Mechanization Scheme

- Select Category: Farmer, Service Provider, or Entrepreneur.

- Register: Use CNIC and mobile number.

- Choose Machinery: Select from 12 high-tech machines.

- Upload Documents: Land record, NTN, or registration certificates.

- Submit Application: Pay PKR 5,000 processing fee and submit.

- Bank Assessment: Credit check and approval.

- Deposit Equity: 20% upfront.

- Loan Disbursement: Bank pays 80% to machinery supplier.

Read More: E Taxi Punjab Gov PK

Machinery Usage and Loan Repayment

- Machinery can only be used for agriculture or agri-service.

- It stays pledged to the bank until full repayment.

- Insurance is mandatory against theft, fire, and accidents.

- Repayment will be done in 20 quarterly installments over 5 years.

Conditions and Restrictions

- Machinery cannot be sold or transferred without bank approval.

- Only one-time subsidy can be availed.

- Delayed payments will have late charges.

- Proper use and maintenance of machinery are mandatory.

Final Thoughts

The High-Tech Mechanization Scheme is a golden chance for Punjab’s farmers and agri-entrepreneurs to modernize their work and grow their income. With interest-free loans up to PKR 30 million, modern equipment, and easy repayment options, the government is making agriculture more efficient and profitable. If you meet the eligibility criteria, apply now and take a step toward smart and modern farming in 2025. This is your time to grow, invest, and earn more from your land.

Related Posts