CM Punjab Meri Gari Scheme

The CM Punjab Meri Gari Scheme 2025 is a new government initiative that helps students, women, job seekers, and low-to-middle-income families buy a car through easy installments and low markup rates. The scheme aims to improve mobility, employment, and income opportunities across Punjab.

Also Read: How To Apply For Kisan Card Loan Scheme 2025

At a Glance

Here’s what makes this scheme special:

- Low down payment

- 3 to 7-year installment plans

- Priority for women and differently-abled persons

- Options for new or certified used cars

- Fully digital application and approval process

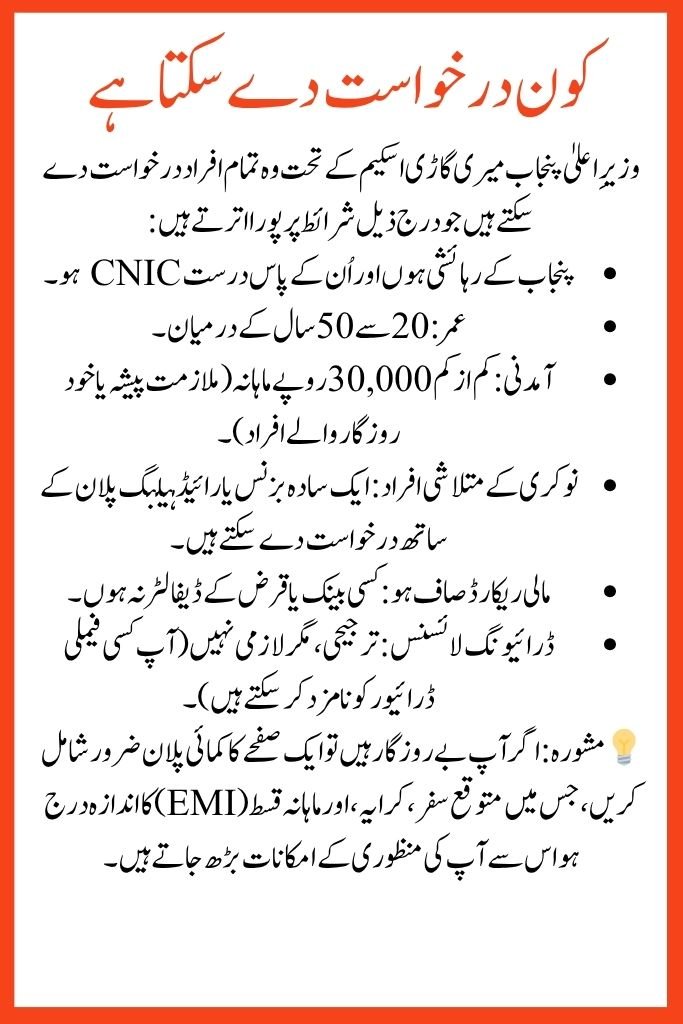

Who Can Apply

Anyone who meets the following conditions can apply under the CM Punjab Meri Gari Scheme:

- Resident of Punjab with a valid CNIC

- Age: Between 20 and 50 years

- Income: Minimum Rs. 30,000 per month (salaried or self-employed)

- Job seekers: Can apply with a simple business or ride-hailing plan

- Clean financial record: Not a loan or bank defaulter

- Driving license: Preferred, but not mandatory (you can nominate a family driver)

💡 Tip: If unemployed, attach a one-page earning plan showing expected trips, fares, and EMI estimates to increase your approval chances.

Documents Required

Before applying, make sure you have these documents ready:

- CNIC (front and back, clear scan)

- Passport-size photo (recent)

- Proof of income (salary slip, bank statement, or business proof)

- Utility bill for address verification

- Driving license (or nominated driver’s license)

- Bank account details for installment deduction

- Quota proof (if applying under women or differently-abled categories)

📄 Tip: Upload only clear and readable PDF or JPG files. Blurred or mismatched documents are the most common reason for rejection.

How to Apply Online (Step-by-Step)

Follow these simple steps to apply for the CM Punjab Meri Gari Scheme:

- Visit the official Punjab Vehicle Finance Program portal.

- Create an account using your CNIC and mobile number (OTP verification).

- Fill in your personal and income details.

- Choose your vehicle type — New or Certified Used (up to 3 years old).

- Upload all required documents.

- Submit your form and note your tracking ID.

- Wait for e-verification and offer confirmation.

- Pay your down payment (if applicable) and sign the financing agreement.

- Collect your vehicle from the authorized dealer after approval.

Installment Plans (Examples)

Below are example costs to help you estimate your monthly payment:

| Vehicle Price | Down Payment | Tenure | Markup | Monthly EMI |

|---|---|---|---|---|

| Rs. 1,600,000 | 15% (Rs. 240,000) | 5 years | ~6% | Rs. 25,000–28,000 |

| Rs. 2,000,000 | 20% (Rs. 400,000) | 6 years | ~6% | Rs. 26,000–30,000 |

| Rs. 2,400,000 | 20% (Rs. 480,000) | 7 years | ~7–8% | Rs. 30,000–35,000 |

💰 Budget Tip: Try to keep your EMI below 35% of your monthly income to avoid financial stress.

What’s New in 2025

Here’s what makes the 2025 version even better:

- Lower markup rates compared to standard auto loans

- Flexible 3–7 year installment options

- New and certified used vehicles for all budgets

- Priority quota for women and differently-abled citizens

- Digital process with faster tracking and transparent approvals

Smart Ways to Earn with Your Car

You can use your vehicle for income generation too:

- Ride-hailing (Careem, InDrive)

- Delivery services (parcels, groceries, food)

- Staff or school pick-and-drop service

- Airport transfers and weekend rentals

📝 Pro Tip: Add your earning plan in the application form to boost approval chances.

Track Your Application

You can easily track your application status:

- Portal: Enter CNIC + Tracking ID

- SMS: Use the official verification code on the portal

- Dealer: Contact your dealer after shortlisting for delivery details

- Support Centers: Visit e-Khidmat centers or use helplines for help

Common Problems & Quick Fixes

| Problem | Cause | Solution |

|---|---|---|

| File rejected | Blurry or mismatched documents | Re-upload clear files |

| Delay in approval | High application volume | Track weekly and follow up after 2–3 weeks |

| EMI mismatch | Hidden bank or insurance charges | Ask for an “all-inclusive EMI” |

| Quota confusion | Wrong category selected | Re-apply under the correct category |

| Delivery delay | Car variant or color unavailable | Ask dealer for an alternate option |

Safety & Compliance Tips

Always remember:

- Apply only through the official government portal

- Avoid agents — no one can “guarantee” approval

- Keep receipts, agreements, and insurance documents safe

- Use auto-debit to ensure timely EMI payments

- Follow local laws if using your car for commercial purposes

Final Words:

The CM Punjab Meri Gari Scheme 2025 is a great opportunity for Punjab residents to own a car with easy financing and government support. Apply smartly, upload clear documents, and make use of this chance to improve your lifestyle and income.

Related Posts