Extension for Manual Tax Returns

For many Pakistani taxpayers, filing tax returns has been a stressful and confusing task. Long queues, paper forms, uncertainty and fear of missing deadlines all add to the burden. Now, as the tax year 2025 approaches, the Federal Board of Revenue (FBR) has announced a final Extension for Manual Tax Returns filing — signaling a major shift to digital tax filing for all. This change isn’t just about paperwork; it’s about bringing ease, transparency and accountability into the tax process.

If you have been delaying your return because of paperwork or form confusion, now is the time to act. The new system aims at an end to manual forms and a full transition to the online portal for filing. With little time left, understanding the new rules, steps and benefits of online filing is critical for every taxpayer across Pakistan.

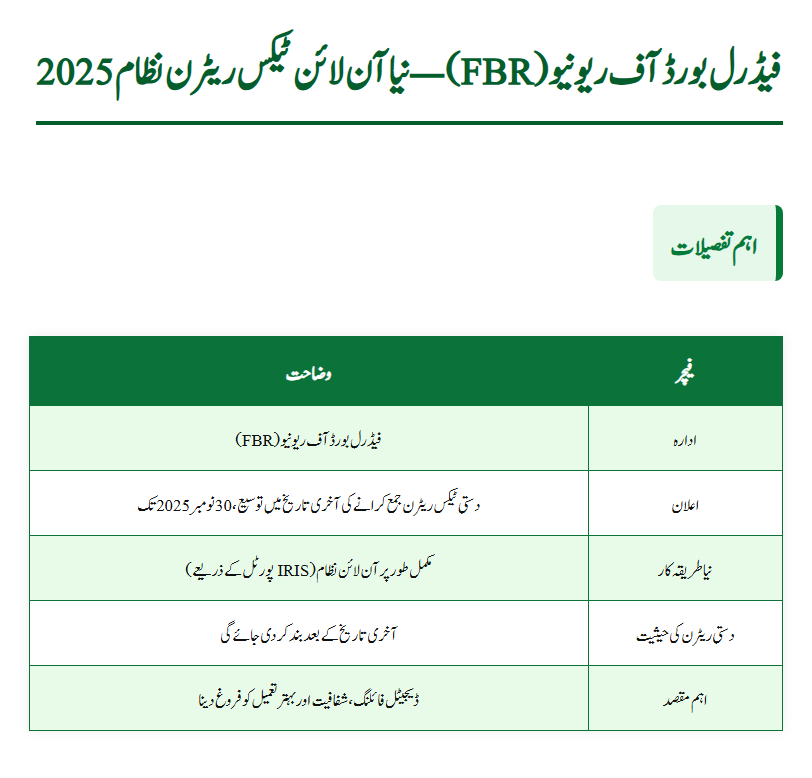

Quick Details

| Feature | Description |

|---|---|

| Organization | Federal Board of Revenue (FBR) |

| Announcement | Final Extension for Manual Tax Returns until Nov 30 2025 |

| New Filing Method | Fully online via IRIS portal |

| Manual Filing Status | To be discontinued after deadline |

| Key Objective | Digital filing, transparency and increased compliance |

Why did the FBR extend manual filings one last time?

The shift to digital tax filing comes after years of the manual system creating bottlenecks: paper errors, delays, long processing times, and limited access for many taxpayers. The final extension is designed to give last-minute relief to those who haven’t yet switched to the online system, while signalling that manual filing will not be available afterward. The objective is to modernize the tax system, ensure faster processing, minimize human intervention and promote transparency in tax compliance.

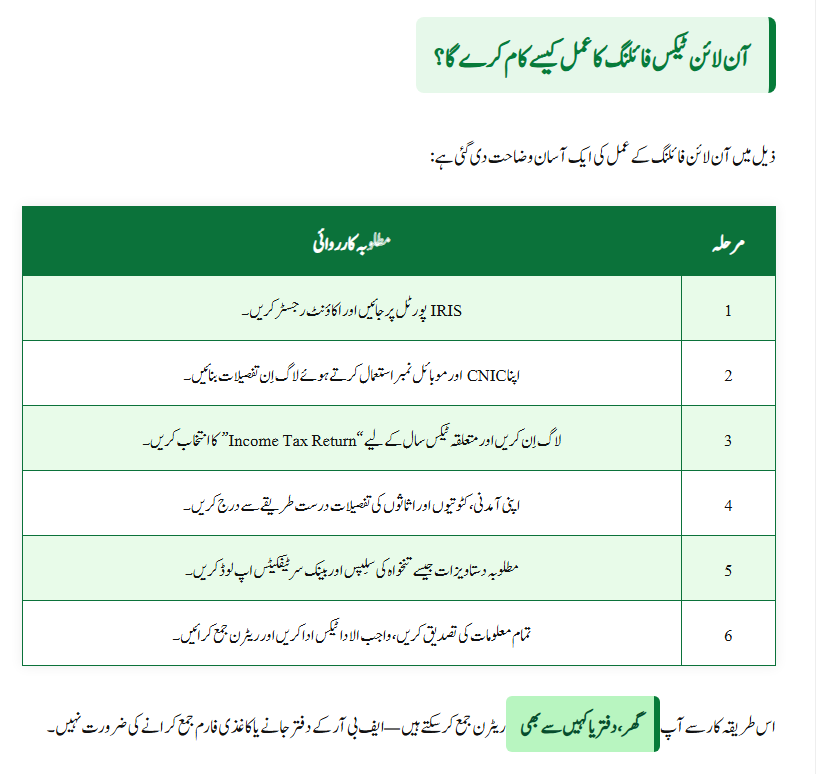

How will the online tax filing process work?

Here is a simplified step-by-step flow of how the online filing system works:

| Step | Action Required |

|---|---|

| 1 | Go to the IRIS portal and register your account. |

| 2 | Create your login credentials using CNIC and mobile number. |

| 3 | Log in and select “Income Tax Return” for the relevant tax year. |

| 4 | Enter all income, deduction and asset details carefully. |

| 5 | Upload required documents like salary slips, bank certificates. |

| 6 | Verify data, pay any due tax and submit your return. |

This method means you can file your return from home, office or on the go — no need to visit an FBR office with paper forms.

Who is required to file returns under the new system?

Under the current tax laws and FBR rules, certain categories of taxpayers must file returns online. Here are the main eligibility conditions:

| Category | Requirement |

|---|---|

| Salaried individuals | Annual income above a threshold (e.g., Rs 600,000) |

| Business persons | Turnover exceeding specified limit (e.g., Rs 300,000) |

| Property owners | Ownership of house above a certain size or land above certain area |

| NTN holders | Individuals with a National Tax Number |

| Vehicle owners | Owning a vehicle of high engine capacity |

Taxpayers in these categories must use the online portal before the manual filing option is closed.Extension for Manual Tax Returns

What are the benefits of filing tax returns online?

Switching to the new digital system provides several practical advantages:

- Faster processing: Returns are verified and processed more quickly than paper forms.

- Greater transparency: Digital records reduce risks of human error and manipulation.

- 24/7 access: You can file at your convenience from anywhere.

- Integrated data: Your bank details, withholding tax and income data sync with the portal.

- Active taxpayer benefits: Being in the Active Taxpayer List (ATL) enables better treatment in transactions and lower withholding rates.

What happens if you miss the deadline for manual filing?

With the closure of manual filing, ignoring the deadline could have serious consequences:

- Non-filers risk penalties under income tax laws.

- Exclusion from the ATL list may lead to higher tax rates and tougher audits.

- Loss of refunds or tax credits might occur if filing is late.

- Increased scrutiny from tax authorities for non-compliance or under-reporting.

It is therefore urgent for eligible taxpayers to make the switch to the online system before the deadline passes.

Frequently Asked Questions (FAQs)

Q1: What is the final deadline for manual tax return filing under FBR?

The new extension sets the final deadline up to November 30, 2025 for manual filings. After that, only online submissions will be accepted.

Q2: Can someone still file manually after the deadline?

No. After the deadline, the FBR has announced that manual return submissions will be discontinued permanently.

Q3: How do I start online filing?

You need to register or log in to the IRIS portal using your CNIC and mobile number, after which you can fill and submit your return digitally.

Q4: Are salaried individuals required to file online too?

Yes. All salaried individuals meeting the income threshold must file online for the tax year specified.

Q5: What support is available to help with online filing?

Taxpayer help-cells in regional tax offices and large taxpayer units are offering assistance for account creation, password recovery, and return submission through November.

Conclusion

The FBR’s announcement of a final Extension for Manual Tax Returns marks a pivotal moment in Pakistan’s move toward a fully digital tax system. The shift to online filing, especially through the IRIS portal, means faster, transparent, and paper-free tax compliance for all.

If you haven’t yet moved your return submission online, this is the urgent call to act. Make sure you register your account, enter your details accurately, submit your tax return before the deadline, and secure your position on the Active Taxpayer List. Embracing this change today means fewer headaches tomorrow and a smoother path to compliance. A modern tax regime begins with you taking the first step.

Related Posts