ATM Cash Withdrawal Tax Pakistan 2025

If you withdraw money from an ATM or bank pawn in Pakistan, you may now sign extra inferences in 2025. This is due to the updated ATM Cash Withdrawal Tax Policy familiarized by the Federal Board of Revenue (FBR) to encourage digital payments, improve certification, and broaden the tax net.

Whether you’re a filer or non-filer, these changes directly affect in what way much tax you’ll pay on cash withdrawals.

Quick Information Table

| Program / Rule | Start Date | End Date | Rate / Assistance | Application Method |

|---|---|---|---|---|

| Withholding Tax on Cash Withdrawals (Non-Filers) | July 1, 2025 (Finance Bill 2025-26) | Ongoing | 0.8% on daily withdrawals above Rs 75,000 (previously Rs 50,000) | Auto deduction via bank/ATM |

| Alternate Proposal (Higher Rate) | 2025 Budget (under review) | Ongoing | Up to 1.2% on daily withdrawals for non-filers | Auto deduction |

| For Filers (ATL Registered) | Current Law (no change yet) | Ongoing | Mostly exempt or minimal tax | Auto deduction |

| Monitoring & CNIC Linking | Active | Continuous | Real-time reporting of all large withdrawals to FBR | Auto system integration |

Note: The government is finalizing the exact rate for FY 2025-26. Some banks have already updated systems for the proposed 0.8%–1.2% deduction on non-filers.

What Is the ATM Cash Withdrawal Tax in Pakistan?

The ATM Cash Withdrawal Tax Pakistan 2025 officially named the Withholding Tax on Cash Withdrawals (Section 231AB, Income Tax Ordinance) is a small percentage subtracted when you withdraw cash after your bank account.

It was introduced to reduce Pakistan’s dependence on cash, dishearten undocumented dealings, and promote traceable, digital banking activity.

If you’re not on the Active Taxpayer List (ATL), you are preserved as a non-filer, and this duty applies to your removals.

Why This Tax Exists

Pakistan’s economy still relies heavily on cash, making it difficult to track transactions and ensure tax compliance. The FBR uses this tax to:

- Encourage people to become tax filers and stay on the ATL.

- Track large cash withdrawals to reduce tax evasion.

- Promote digital payments and banking transparency.

- Strengthen national revenue and IMF compliance goals.

In short, it’s not just a tax — it’s part of a larger plan to build a digital and documented economy.

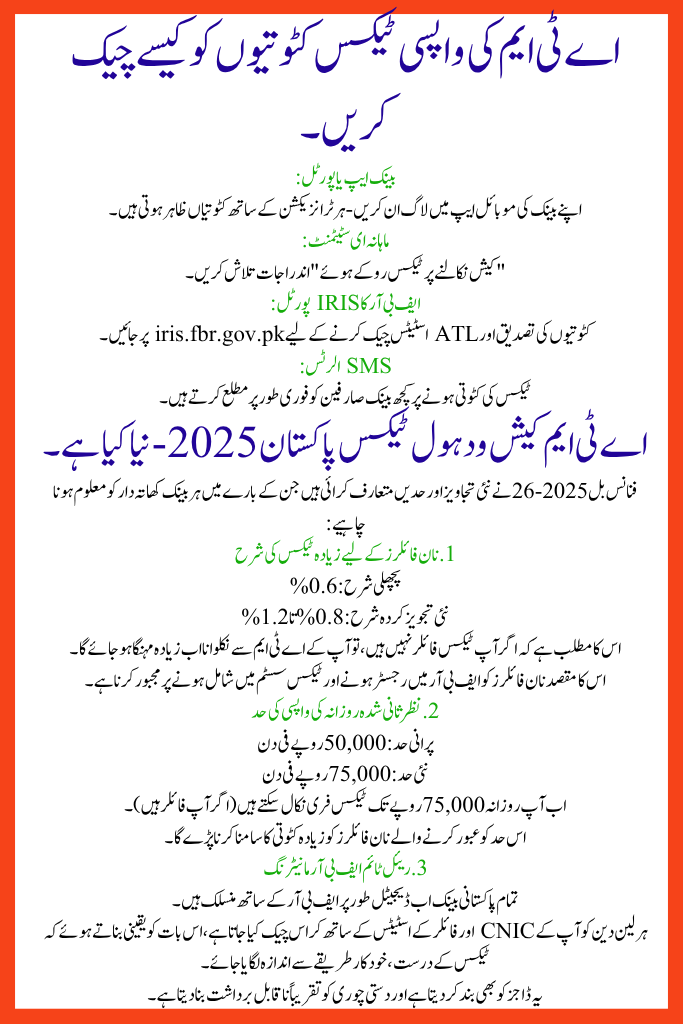

ATM Cash Withdrawal Tax Pakistan 2025 – What’s New

The Finance Bill 2025-26 has introduced new proposals and thresholds that every bank account holder should know:

1. Higher Tax Rate for Non-Filers

- Previous Rate: 0.6%

- New Proposed Rate: 0.8% to 1.2%

This means if you’re not a tax filer, your ATM withdrawals will now be more expensive.

The goal is to push non-filers to register with the FBR and join the tax system.

2. Revised Daily Withdrawal Limit

- Old Limit: Rs 50,000/day

- New Limit: Rs 75,000/day

You can now withdraw up to Rs 75,000 per day tax-free (if you’re a filer).

Non-filers crossing this limit will face the higher deduction.

3. Real-Time FBR Monitoring

All Pakistani banks are now digitally linked with the FBR.

Every transaction is cross-checked with your CNIC and filer status, ensuring precise, automatic tax inferences.

This also closes dodges and makes manual evasion nearly unbearable.

Comparison Table – 2025 ATM Tax Rates

| Account Type | Daily Withdrawal | Filer Status | Tax Rate | Tax Amount |

|---|---|---|---|---|

| Filer | Rs 60,000 | Filer (ATL) | 0% | Rs 0 |

| Non-Filer | Rs 100,000 | Not on ATL | 1.2% | Rs 1,200 |

| Small Withdrawal | Rs 40,000 | Any | 0% | Rs 0 |

| Business Non-Filer | Rs 200,000 | Non-Filer | 1.2% | Rs 2,400 |

👉 Insight: Non-filers lose nearly 4x more money in taxes compared to filers. Becoming a filer saves significant amounts each year.

Purpose Behind the 2025 Policy

TheATM Cash Withdrawal Tax Pakistan 2025 FBR’s tax policy has several objectives:

- Increase tax filing by discouraging non-filers.

- Boost digital payments like debit cards, QR codes, and online transfers.

- Enhance transparency and traceability in financial activity.

- Expand the tax base for economic growth.

- Align with “Digital Pakistan Vision 2025”, aiming for financial inclusion.

Impact on Filers vs Non-Filers

For Filers

- Mostly exempt from withdrawal tax (if within limit).

- Enjoy smooth banking operations and lower scrutiny.

- Eligible for FBR rewards and lower rates on other taxes.

For Non-Filers

- Pay up to 1.2% tax on large ATM withdrawals.

- Face higher scrutiny and may be flagged for documentation checks.

- May struggle to open or maintain business or foreign accounts.

💡 Moral: Becoming a filer not only saves money but also increases your financial credibility.

How to Check ATM Withdrawal Tax Deductions

- Bank App or Portal:

Log in to your bank’s mobile app — deductions appear beside each transaction. - Monthly E-Statement:

Look for “Withholding Tax on Cash Withdrawal” entries. - FBR’s IRIS Portal:

Visit iris.fbr.gov.pk to verify deductions and check ATL status. - SMS Alerts:

Some banks instantly notify customers when tax is deducted.

Tips to Reduce ATM Withdrawal Tax in 2025

- Become a Tax Filer – Register on the FBR IRIS portal and file your annual return.

- Use Digital Payments – Pay bills via debit/credit cards, mobile apps, or QR payments — all tax-free.

- Plan Withdrawals – Withdraw smaller amounts below the Rs 75,000 limit.

- Monitor Your Statements – Check if deductions are correct and report errors.

- Avoid Heavy Cash Usage – Use mobile wallets like Easypaisa, JazzCash, or NayaPay for small payments.

Impact on Pakistan’s Economy

| Area | Expected Benefit |

|---|---|

| Tax Compliance | More Pakistanis filing returns |

| Digital Banking | Increased e-payment adoption |

| Cash Dependency | Reduction in untracked cash usage |

| Revenue Growth | Higher FBR collections |

| Transparency | Improved financial documentation |

These reforms aim to make Pakistan’s economy stronger, digital, and IMF-compliant by reducing cash-based transactions.

FAQs–ATM Cash Withdrawal Tax Pakistan 2025

What is the current ATM tax rate in Pakistan (2025)?

Non-filers pay between 0.8% and 1.2% on daily withdrawals above Rs 75,000. Filers are mostly exempt.

Does every ATM withdrawal have a tax?

No. Withdrawals below Rs 75,000/day are tax-free.

How can I check if tax was deducted?

Check your bank app, statement, or FBR IRIS portal for deduction details.

Are online payments also taxed?

No. Digital payments are exempt from cash withdrawal tax.

How can I become a tax filer in Pakistan?

Register on iris.fbr.gov.pk, file your annual tax return, and appear on the Active Taxpayer List (ATL).

Conclusion

The ATM Cash Withdrawal Tax Pakistan 2025 is a key step in Pakistan’s move to a documented, digital economy.

Non-filers will now face higher deductions — up to 1.2% — while filers enjoy abridged or zero tax.

By becoming a filer, using digital banking, and handling your cash wisely, you can save cash and donate to Pakistan’s financial progress.

Related Posts