EOBI Login & Pension Check 2025

The Employees’ Old-Age Benefits Institution (EOBI) in Pakistan now offers a additional user-friendly on portal in 2025. Through this portal, insured employees then pensioners can log in, check their pension eligibility, see contribution history, and verify monthly payments — all from home deprived of having to visit workplaces. In this leader, you will find step-by-step instructions, eligibility rules, common issues, and tips so you can confidently use the scheme.

Here is a quick summary before diving into full details:

| Field | Details |

|---|---|

| Institution | EOBI (Employees’ Old-Age Benefits Institution) |

| Portal / Service | EOBI login, pension check, contribution history |

| Online Access Start (2025) | Available (Upgraded) |

| Method of Access | Online via official website / portal |

| Required Info | CNIC, EOBI registration number, password / OTP |

| Benefits | Pension eligibility status, contributions, payment records |

What Is EOBI and Why Online Access Matters

What Is EOBI?

The Employees’ Old-Age Benefits Institution (EOBI) is a administration body in Pakistan that handles annuities and social security for listed private-sector staffs. It was recognized below the EOBI Act 1976.

EOBI provides several benefits such as:

- Old-age pension

- Invalidity pension

- Survivor pension (for dependents)

- Old-age grant (if minimum conditions for full pension are not met)

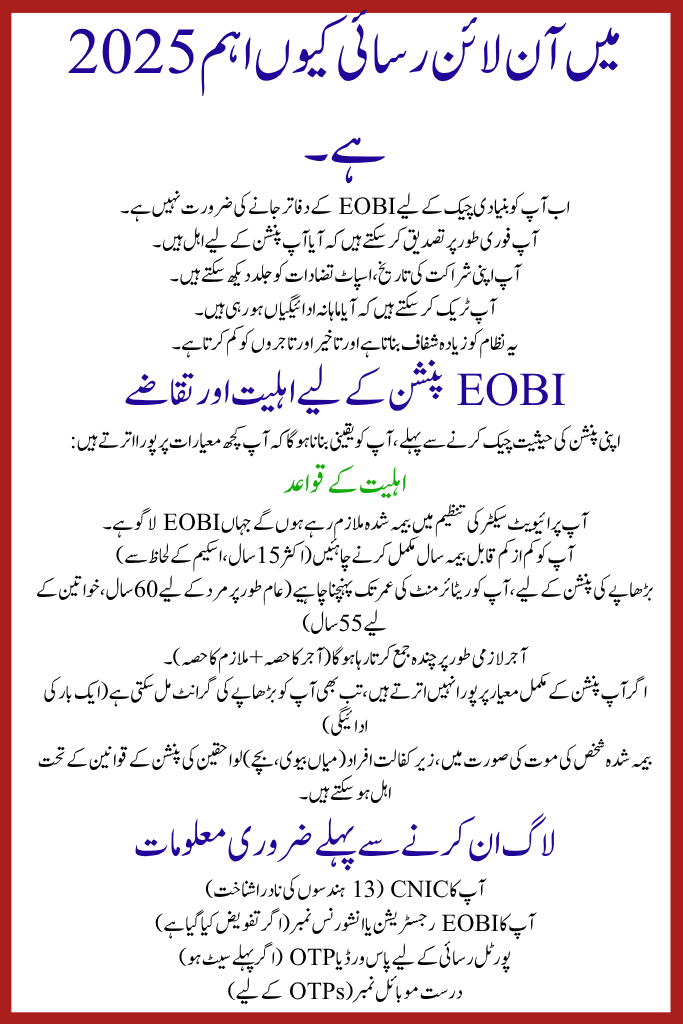

Why Online Access Is Important in 2025

- You no longer need to visit EOBI Login & Pension Check 2025 EOBI offices for basic checks.

- You can instantly verify whether you’re qualified for pension.

- You can see your contribution history, spot discrepancies early.

- You can track whether monthly payments are being made.

- It makes the system more transparent and lessens delays and traders.

Eligibility & Requirements for EOBI Pension

Before checking your pension status, you need to ensure you satisfy certain criteria:

Eligibility Rules

- You must have been an insured employee in a private-sector organization where EOBI is applicable.

- You should have completed a minimum number of insurable years (often 15 years, depending on scheme)

- For old-age pension, you must reach retirement age (commonly 60 years for male, 55 years for female)

- Employer must have been regularly depositing contributions (employer’s share + employee’s share).

- If you don’t meet full pension criteria, you might still get an old-age grant (a one-time payout)

- In case of death of insured person, dependents (spouses, children) may be eligible under survivor pension rules.

Required Information Before You Log In

- Your CNIC (13-digit NADRA identity)

- Your EOBI registration or insurance number (if assigned)

- Password or OTP for portal access (if previously set)

- Valid mobile number (for OTPs)

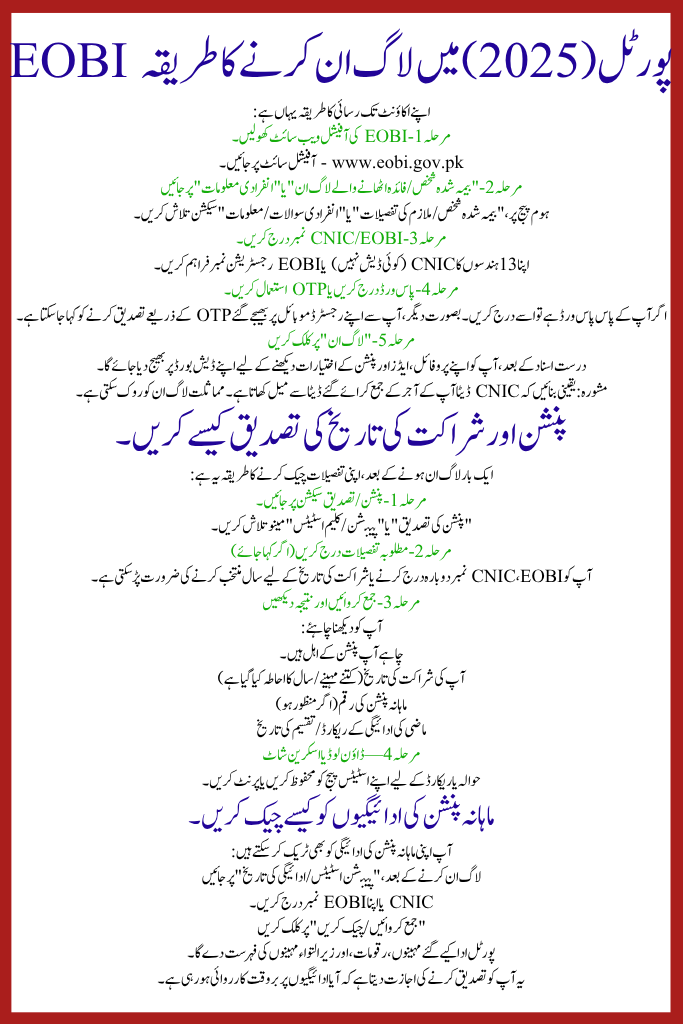

How to Log In to the EOBI Portal (2025)

Here’s how to access your account EOBI Login & Pension Check 2025:

Step 1 — Open the Official EOBI Website Go to official website www.eobi.gov.pk

Step 2 — Go to “Insured Person / Beneficiary Login” or “Individual Information”

On the homepage, look for “Insured Person / Employee Details” or “Individual Queries / Info” section.

Step 3 — Enter CNIC / EOBI Number

Provide your 13-digit CNIC (no dashes) or EOBI registration number.

Step 4 — Enter Password or Use OTP

If you have a password, enter it; otherwise, you may be asked to verify via OTP sent to your registered mobile.

Step 5 — Click “Login”

After correct credentials, you will be directed to your dashboard viewing your profile, aids, and pension options.

Tip: Make sure the CNIC data matches what your employer submitted; mismatch may block login.

How to Verify Pension & Contribution History

Once logged in EOBI Login & Pension Check 2025, here’s how to check your details:

Step 1 — Go to Pension / Verification Section

Look for “Pension Verification” or “Pension / Claim Status” menu.

Step 2 — Enter Required Details (if prompted)

You might need to re-enter CNIC, EOBI number or select year(s) for contribution history.

Step 3 — Submit & View Result

You should see:

- Whether you are eligible for pension

- Your contribution history (how many months/years covered)

- Monthly pension amount (if approved)

- Past payment records / disbursement history

Step 4 — Download or Screenshot

Save or print your status page for reference or record.

How to Check Monthly Pension Payments

You can also track your monthly pension disbursements:

- After login, go to “Pension Status / Payment History”

- Enter CNIC or your EOBI number

- Click “Submit / Check”

- The portal will list the months paid, amounts, and pending ones

This allows you to confirm if payments are being processed timely.

Common Issues & Troubleshooting

Even with the upgraded portal, some users face issues. Here’s how to solve them:

| Issue | Solution |

|---|---|

| Forgot password | Use “Forgot Password” link, verify via OTP, reset password |

| Invalid CNIC or login fails | Double-check CNIC format; confirm employer submitted correct data |

| OTP not received | Make sure your mobile number is registered; check network; try again later |

| Portal not loading | Clear browser cache; use supported browser (Chrome, Firefox); try off-peak hours |

| Contribution not appearing | Contact employer / HR; request EOBI to verify missing months |

| Pension amount seems low | Review your years of service, average wage basis; submit correction queries |

How Employers Help & Their Responsibilities

Employers play a key role, because pension benefits are based on their correct input:

- They must register with EOBI and report employees to EOBI.

- They must submit monthly contributions (employer + employee share) timely.

- They should ensure correct CNIC, joining date, salary info are entered.

- If discrepancies arise, employer should coordinate with EOBI to fix issues.

When employers do their part accurately, employees’ pension access becomes smooth.

Why EOBI Online Verification Is Critical in 2025

- Catch errors early: If your employer missed contributions or typed wrong data, you can spot it.

- Plan your pension: See how many years you’ve accumulated, and when you’ll qualify.

- Transparency: No hidden delays or mystery payments.

- Convenience: No need for repeated office visits.

- Security: Your pension records are digital and stored securely.

Tips for Safe & Reliable Use of the EOBI Portal

- Always use official URL (www.eobi.gov.pk) — avoid fake sites.

- Keep your password and OTP private.

- Avoid using public WiFi when logging in.

- Update mobile number if you change SIM or telecom operator.

- Download or screenshot critical pages (payment, verification) as backup.

- Log out properly after each session.

(FAQs)– EOBI Login & Pension Check 2025

Can I check EOBI pension without registering?

Basic checks may be likely via CNIC, but full access (contribution details, claims) needs having portal admission or registering.

How long until contributions reflect online?

Generally aids posted by employers show up in 7–10 occupational days, contingent on dispensation.

Can I check via mobile?

Yes, the portal is mobile-friendly and there is a dedicated EOBI mobile app as well.

What to do if pension amount is wrong?

Contact your employer and EOBI regional office; submit a correction request with proof of missing months.

Will dependents get pension if insured person dies?

Yes, under survivor pension rules, spouse or children may receive benefits if the insured satisfied eligibility.

What if I don’t meet full 15 years of contributions?

You may be eligible for old-age grant (one-time grant) instead of full pension.

Conclusion

The upgraded EOBI Login & Pension Check 2025 scheme empowers retirees and insured labors across Pakistan. Through a humble CNIC login, you can:

- Verify pension eligibility

- See full contribution history

- Track monthly payments

- Catch errors early

- Save time and avoid office visits

But ensure you meet eligibility requirements, your boss submits accurate data, then you use the portal prudently and firmly. If you face issues, use the “Forgot Password” option or interaction your local EOBI office.

Related Posts