Gold in Pakistan Hits a New Record High

Once again, tough news has arrived for the people of Pakistan. Gold in Pakistan has reached a new all-time high, breaking all previous records. For many households, gold has always symbolized wealth, safety, and tradition — but now it’s becoming harder than ever to afford.

Rising gold prices have caused serious concern among shopkeepers, jewelers, and middle-class families. The economic pressure was already unbearable due to inflation, and this new jump in gold prices has made life even more difficult.

Experts say this rise is not sudden — it’s the result of global market trends, a weaker rupee, and growing economic uncertainty. While investors see gold as a safe haven, ordinary Pakistanis see it as another blow to their already tight budgets.

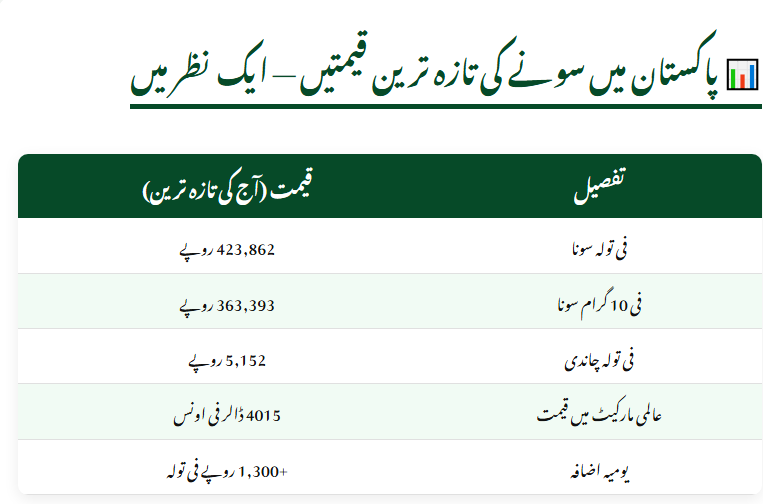

📊 Latest Gold

| Detail | Price |

|---|---|

| Per Tola Gold | Rs. 423,862 |

| Per 10 Grams Gold | Rs. 363,393 |

| Per Tola Silver | Rs. 5,152 |

| Global Market Price | $4,015 per ounce |

| Daily Increase | +Rs. 1,300 per tola |

❓ Why Has Gold in Pakistan Become So Expensive?

According to financial experts, the main reason behind the rise of Gold in Pakistan Hits a New Record High isn’t just the international market — the continuous depreciation of the Pakistani rupee is also a major factor.

When the value of the rupee drops, imported goods become more expensive, and gold — being an imported commodity — immediately reflects that change. Even though the rupee showed slight improvement in recent weeks, the global surge in gold prices offset any local relief.

Economists also point to political instability and limited investment options in Pakistan, which drive people toward gold as a safer choice. The more people buy gold, the higher the prices climb.

🌍 Key Reasons Behind the Global Gold Price Surge

| Reason | Explanation |

|---|---|

| Global Economic Uncertainty | Investors prefer safe assets like gold. |

| Geopolitical Tensions | Ongoing conflicts in the Middle East and Europe impact markets. |

| Dollar Fluctuations | When the dollar weakens, gold becomes more valuable. |

| Inflation Worldwide | Gold protects against inflationary pressure. |

❓ Can Ordinary Pakistanis Still Afford Gold?

For the average citizen, buying Gold in Pakistan Hits a New Record High is now nearly impossible. Families preparing for weddings are turning to artificial jewelry as real gold slips out of reach.

Jewelers report that gold sales have dropped by almost 40–50% in the past few months. Where gold shops were once crowded, they now stand nearly empty.

The middle class — which traditionally saw gold as both beauty and security — can no longer afford it due to reduced income and higher living costs.

Meanwhile, the investor class continues to buy gold, seeing it as a shield against inflation and currency volatility.

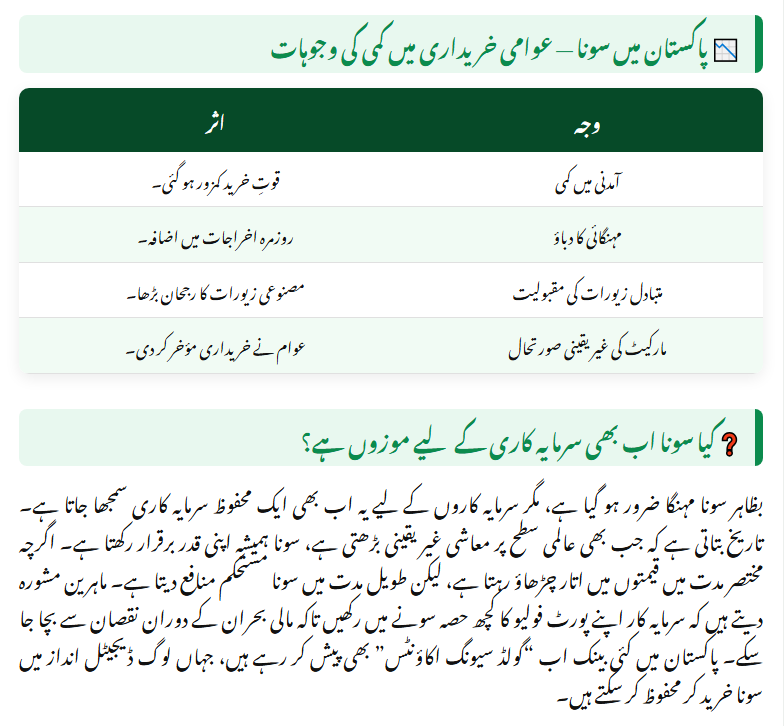

📉 Why Gold Buying Has Dropped Among the Public

| Reason | Effect |

|---|---|

| Decrease in Income | Purchasing power has fallen sharply. |

| Rising Inflation | Daily expenses have become unbearable. |

| Popularity of Imitation Jewelry | People are switching to cheaper alternatives. |

| Market Instability | Buyers are delaying purchases. |

❓ Is Gold Still a Good Investment in Pakistan?

Even though gold is currently expensive, financial experts still consider it one of the safest long-term investments.

History shows that whenever the global economy faces instability, gold retains its value and even grows over time.

While short-term fluctuations are common, gold generally provides consistent returns in the long run.

Experts recommend investing only a portion of one’s savings in gold to minimize risk. In Pakistan, several banks now offer digital gold saving accounts, making it easier for people to invest securely without physically storing gold.

💰 Best Ways to Invest in Gold in Pakistan

| Method | Details |

|---|---|

| Physical Gold (Bars/Coins) | Ideal for long-term investors. |

| Gold Saving Accounts | Offered by several banks for safe digital investment. |

| Jewelry Investment | Traditional but less liquid form of investment. |

| Global Gold Funds | Good for online or international investors. |

❓ Can the Government Control Gold Prices in Pakistan?

Many people believe the government can reduce gold prices, but in reality, it can’t directly control them. Gold prices are tied to international markets, not local policy. However, the government can stabilize the rupee, reduce import taxes, and crack down on smuggling — all of which can help keep the gold market more stable. According to the Ministry of Finance, authorities are already taking measures to control illegal trade and ensure that gold remains available at fair market rates.

Conclusion

Gold has always held a special place in Pakistan’s economy and culture. But in today’s conditions, Gold in Pakistan Hits a New Record High has turned into a luxury for the rich. Unless the rupee strengthens, inflation cools, and the global economy stabilizes, gold prices are unlikely to drop significantly.

The government must focus on stabilizing the currency, promoting local investment, and protecting consumers from inflationary shocks.

For now, gold remains a dream for the average Pakistani — shining brightly, but far out of reach.

Official Reference:

🔗 www.sbp.org.pk

💬 Frequently Asked Questions (FAQs)

1. Why are gold prices increasing in Pakistan?

Because of global market trends, a weak Pakistani rupee, and growing investor demand for safe assets like gold.Gold in Pakistan Hits a New Record High

2. What is the current gold price in Pakistan?

As of today, gold is priced at Rs. 423,862 per tola and Rs. 363,393 per 10 grams.

3. Is it a good time to invest in gold in Pakistan?

Yes, but only for long-term investors. Gold provides stability during inflation and currency fluctuations.

4. Can the government reduce gold prices?

Not directly. Gold prices depend on international markets, but the government can stabilize the rupee to slow price increases.

5. Will gold prices in Pakistan go down soon?

Experts believe prices are unlikely to fall soon due to ongoing global instability and a weak rupee.

Related Posts