Owning a home in Pakistan has become increasingly difficult for middle-class and low-income families due to high property prices and limited access to financing. To help these citizens, the Government of Pakistan, in collaboration with the State Bank of Pakistan (SBP), launched the Mera Ghar Mera Ashiana Scheme 2025. Under this housing initiative, Askari Bank plays an important role by offering low markup home loans with easy documentation and flexible repayment plans. The program’s goal is to make home ownership easier for first-time buyers through government subsidy, long tenures, and transparent processing.

Overview of Mera Ghar Mera Ashiana Scheme 2025

The Mera Ghar Mera Ashiana 2025 housing finance plan is a government-supported loan scheme that helps Pakistanis purchase or build their first homes. It provides subsidized markup rates, long repayment periods, and simple eligibility conditions for quick loan approval through Askari Bank.

| Feature | Details (Askari Bank – 2025 Update) |

|---|---|

| Scheme Type | Government-Subsidized Housing Finance |

| Participating Bank | Askari Bank |

| Eligibility | First-time homebuyers |

| Loan Purpose | Purchase or construction of house/flat |

| Tenure | Up to 20 years |

| Subsidy Duration | First 10 years |

| Buyer Equity | 10% of property value |

| Financing | Up to 90% |

| Max Loan Limit | PKR 3.5 million |

This program makes home loans affordable for people who could not qualify for traditional banking finance before.

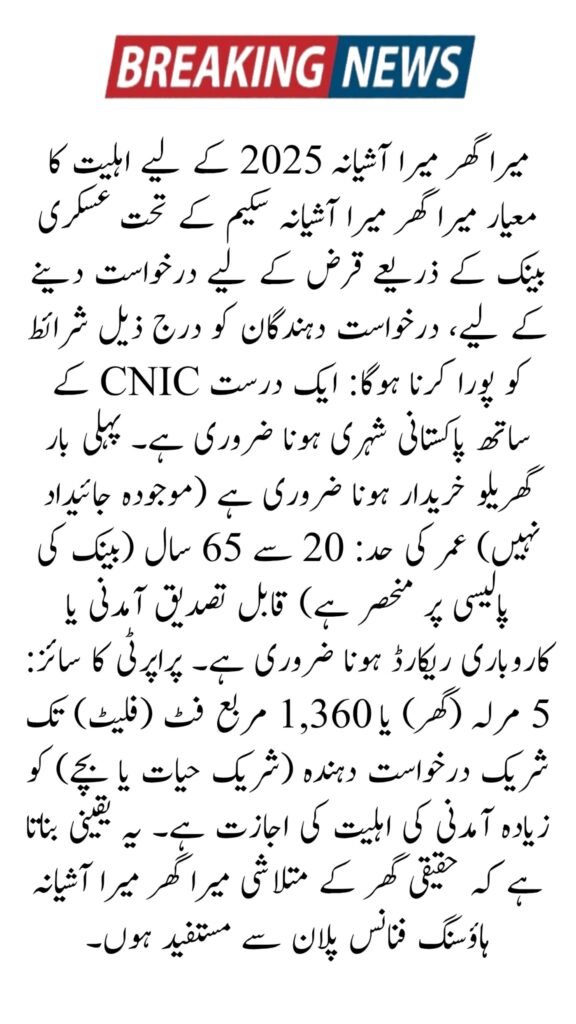

Eligibility Criteria for Mera Ghar Mera Ashiana 2025

To apply for a loan through Askari Bank under the Mera Ghar Mera Ashiana Scheme, applicants must fulfill the following conditions:

- Must be a Pakistani citizen with a valid CNIC

- Must be a first-time homebuyer (no existing property)

- Age limit: 20 to 65 years (depending on bank’s policy)

- Must have verifiable income or business records

- Property size: up to 5 marla (house) or 1,360 sq. ft (flat)

- Co-applicant (spouse or child) allowed for higher income eligibility

This ensures that genuine home seekers benefit from the Mera Ghar Mera Ashiana housing finance plan.

Financial Structure and Loan Tiers under Askari Bank

The Askari Bank Mera Ghar Mera Ashiana Loan 2025 is divided into two main tiers based on loan limits and markup rates. The government subsidizes the markup for the first 10 years, reducing monthly payments.

| Tier | Loan Range | Subsidy Period | Fixed Markup Rate | Maximum Tenure |

|---|---|---|---|---|

| Tier 1 | Up to PKR 2 million | 10 years | 5% | 20 years |

| Tier 2 | PKR 2–3.5 million | 10 years | 8% | 20 years |

Additional Financial Details:

- Down Payment: 10% of total value

- Bank Financing: Up to 90%

- Processing Fees: None

- Prepayment Penalty: Not applicable

- Risk Coverage: 10% guaranteed by SBP

This structure makes it possible to get a long-term, low-interest home loan without heavy financial burden.

Required Documents for Application

Applicants must submit the required documents to ensure quick and smooth approval for the Askari Bank housing loan under the Mera Ghar Mera Ashiana 2025 program.

Documents Needed:

- Copy of CNIC (Applicant & Co-applicant)

- Passport-size photographs

- Salary slips (for salaried individuals)

- Six-month bank statement

- Business proof or financial records (for self-employed)

- Property documents (ownership or purchase)

- Filled Askari Bank application form

Make sure all documents are valid and complete before applying to avoid delays.

Step-by-Step Loan Approval Process

Follow these steps to apply for a home loan via Askari Bank under the Mera Ghar Mera Ashiana Scheme 2025:

- Visit any Askari Bank branch and request the housing finance form.

- Fill out the form with accurate details.

- Attach all required documents.

- Bank verifies income, CNIC, and property information.

- Property evaluation and legal check are done.

- Once approved, loan funds are disbursed directly for purchase or construction.

- Repayment starts as per agreed monthly installments.

- Full ownership is transferred after repayment completion.

Top Benefits of Mera Ghar Mera Ashiana Scheme via Askari Bank

Applying through Askari Bank provides transparent, flexible, and reliable loan processing under the Mera Ghar Mera Ashiana 2025 initiative.

| Benefit Type | Details |

|---|---|

| Low Markup | 5%–8% fixed for 10 years |

| Long Tenure | Up to 20 years repayment period |

| Down Payment | Only 10% required |

| Hidden Charges | None |

| Prepayment | No penalty |

| Customer Support | Full assistance from Askari Bank team |

| Government Support | SBP-backed subsidy and risk coverage |

Tip: Always confirm that your housing society or property is approved by Askari Bank before applying for the loan.

Common Tips for Smooth Loan Approval

To avoid rejection or delays:

- Prepare all documents before applying.

- Ensure your property is in an approved housing society.

- Maintain a clean bank record.

- Respond quickly to verification calls or document requests.

- Discuss clearly about markup rate reset after 10 years of subsidy.

Conclusion

The Mera Ghar Mera Ashiana Scheme 2025 via Askari Bank is a great opportunity for low and middle-income citizens of Pakistan to become homeowners. With low markup, long repayment plans, and no hidden fees, the scheme promotes financial inclusion and housing growth across the country. Visit your nearest Askari Bank branch or check SBP official website for updated loan information and application forms.

FAQs About Mera Ghar Mera Ashiana 2025

1. Who can apply for this housing scheme?

Any Pakistani citizen aged 20–65 years buying their first home can apply.

2. What is the maximum loan amount from Askari Bank?

Up to PKR 3.5 million, depending on income and property size.

3. Are there any processing fees?

No, Askari Bank charges no processing fees or hidden costs.

4. Can I include my spouse as a co-applicant?

Yes, you can combine income with your spouse or child to increase eligibility.

5. Is property valuation mandatory?

Yes, property valuation and verification are compulsory before loan approval.

Related Posts