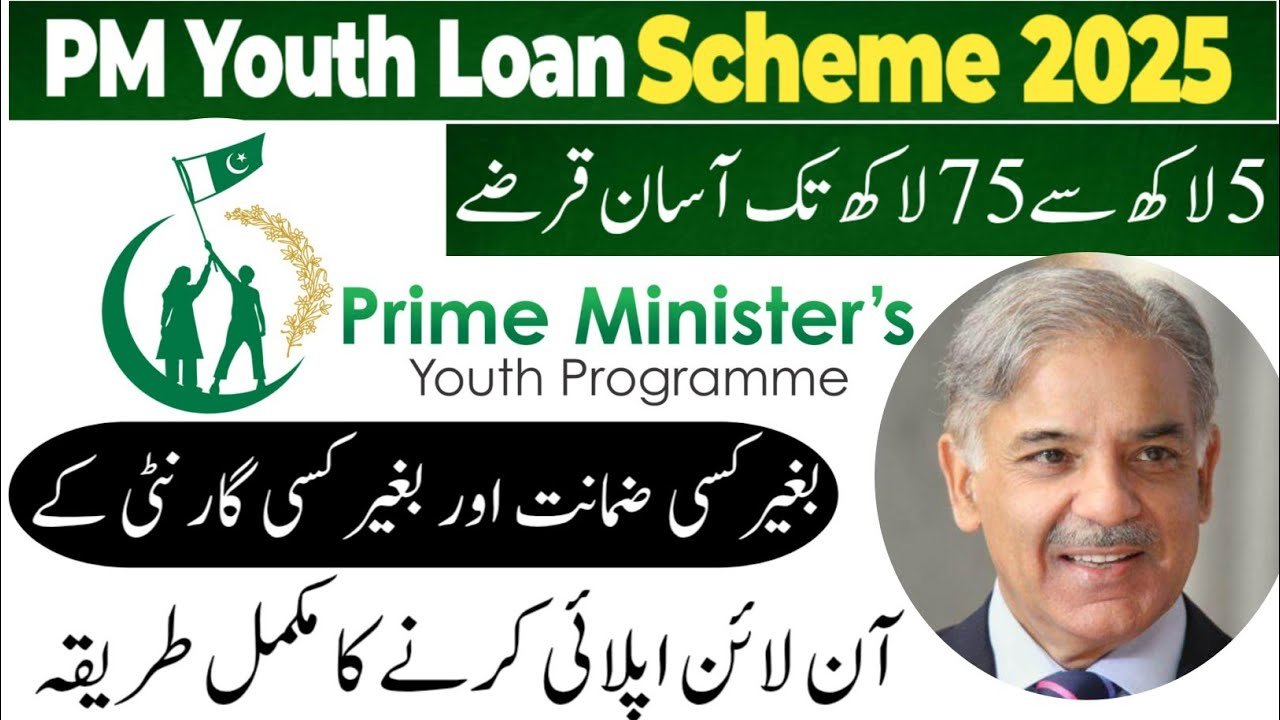

The PM Youth Loan Scheme 2025 is a flagship initiative by the Government of Pakistan to empower young entrepreneurs, freelancers, and small business owners. Through this scheme, eligible applicants can receive interest-free and low-markup business loans from Rs 5 lakh to Rs 75 lakh. The goal is to reduce unemployment, support startups, and grow Pakistan’s digital and small-enterprise economy.

| Category | Details |

|---|---|

| Scheme Name | PM Youth Loan Scheme 2025 |

| Loan Range | Rs 5 lakh – Rs 75 lakh |

| Interest Rate | 0 % – 7 % (based on tier) |

| Repayment Period | 8 years |

| Grace Period | 1 year |

| Apply Online | https://pmyp.gov.pk |

Main Goals of the Scheme

The PM Youth Loan Scheme 2025 aims to create a new generation of business leaders in Pakistan.

- Promote Entrepreneurship: Help youth start and grow their own ventures.

- Support SMEs & Startups: Boost productivity and innovation.

- Inclusive Financing: Ensure equal opportunities for women, freelancers, and differently-abled youth.

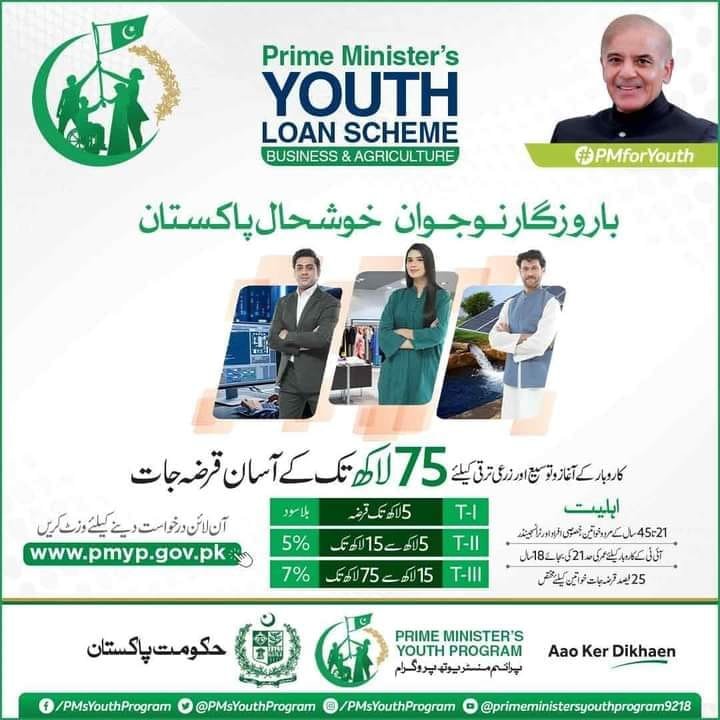

Loan Tiers & Repayment Structure

The program offers three loan tiers with flexible repayment plans:

- Tier 1: Rs 5 – 15 lakh → 0 % markup (interest-free)

- Tier 2: Rs 15 – 50 lakh → 5 % markup

- Tier 3: Rs 50 – 75 lakh → 7 % markup

Each borrower gets up to 8 years for repayment and a 1-year grace period. Over Rs 100 billion has been allocated to reach rural and underprivileged youth.

Eligibility Criteria for Applicants

To apply for the PM Youth Loan Program 2025, the following conditions apply:

- Pakistani citizen with a valid CNIC

- Age limit: 21 – 45 years (18 years for IT or e-commerce sector)

- Must have a startup idea or running business

- 25 % quota reserved for women entrepreneurs

These requirements keep the scheme fair and inclusive nationwide.

How to Apply Online for PM Youth Loan Scheme 2025

Applying is quick and fully online.

- Go to https://pmyp.gov.pk

- Select “PM Youth Loan Scheme 2025 – Apply Online”

- Enter your CNIC, name, and business details

- Upload required documents (CNIC copy, photo, proof of income)

- Submit the form and note your tracking ID

You can later track your application status via SMS or the same portal.

Key Benefits of the Scheme

The PM Youth Loan Scheme 2025 provides one of the most supportive financing packages for Pakistani youth.

- Interest-free financing up to Rs 15 lakh (Tier 1)

- Collateral-free loans and easy installments

- 25 % quota for women entrepreneurs

- Loans available through NBP, HBL, UBL, BOP, Meezan Bank

- Supports IT, agriculture, manufacturing, and renewable-energy projects

These benefits make it an ideal solution for starting or expanding a business in 2025.

Priority Sectors for 2025

The scheme focuses on sectors that can generate sustainable growth and employment.

- Information Technology & Freelancing: E-commerce, software houses, digital services

- Agriculture & Livestock: Dairy, poultry, fisheries, agribusiness projects

- Manufacturing & Cottage Industries: Textiles, handicrafts, local production

- Renewable Energy: Solar power, biogas, eco-solutions

- Transport & Logistics: E-bikes, delivery services, ride-sharing ventures

These areas align with Pakistan’s vision for youth-led economic growth.

Government Update – October 2025

Recent reports show over 150,000 applications already received. Punjab and Sindh lead in loan approvals.

- Dedicated bank desks for youth applicants

- Rural women entrepreneurs prioritized

- IT startups given fast-track processing

The updates highlight the government’s effort to ensure quick disbursement and equal access for every region.

Conclusion

The PM Youth Loan Scheme 2025 is transforming Pakistan’s youth economy. With interest-free loans, digital applications, and sector-specific support, it gives young citizens the financial strength to innovate, create jobs, and build sustainable businesses. Apply now through the official portal https://pmyp.gov.pk and take your first step toward financial freedom.