SBP Mera Ghar Mera Ashiana Scheme

For years, millions of Pakistani families have dreamed of owning their own homes — but rising inflation, high property prices, and strict bank requirements made that dream nearly impossible. Now, there’s a new ray of hope. The SBP Mera Ghar Mera Ashiana Scheme 2025, launched by the State Bank of Pakistan in partnership with the Government of Pakistan, aims to make home ownership a reality for low- and middle-income families.

Through this government-backed housing loan program, eligible citizens can buy, build, or expand their homes with low markup rates, easy monthly installments, and long-term repayment options. This initiative gives hardworking Pakistanis a chance to secure their family’s future — not through charity, but through opportunity.

Quick Details

| Detail | Information |

| Scheme Name | SBP Mera Ghar Mera Ashiana Scheme 2025 |

| Introduced By | State Bank of Pakistan |

| Target Group | Low and middle-income families |

| Loan Duration | Up to 20 years |

| Official Website | https://www.sbp.org.pk |

Why Did the SBP Launch the Mera Ghar Mera Ashiana Scheme 2025?

Owning a house has become increasingly difficult for most Pakistanis due to sky-high property prices. To address this issue, the Government of Pakistan and the State Bank of Pakistan (SBP) launched the Mera Ghar Mera Ashiana Scheme 2025.

The program allows banks to provide housing loans at low markup rates, with the government offering markup subsidies and risk-sharing guarantees. Its goal is simple yet powerful — to make “Ghar Har Pakistani Ka” (A Home for Every Pakistani) a reality by promoting affordable housing and financial stability for working families.

Read Also: PM Electric Bike Scheme Balloting List Announced

What Makes SBP Mera Ghar Mera Ashiana Scheme 2025 Unique?

This scheme brings real relief for ordinary people who want to own homes without being crushed by financial pressure. Here are its main benefits:

- Available to any Pakistani with a valid CNIC and no existing home.

- Loans can be used to buy, build, or expand a house.

- Applicable for up to 5 marla houses or 1,360 sq. ft. flats.

- Up to 20 years repayment period.

- Government subsidy for the first 10 years.

- No hidden fees or early payment penalties.

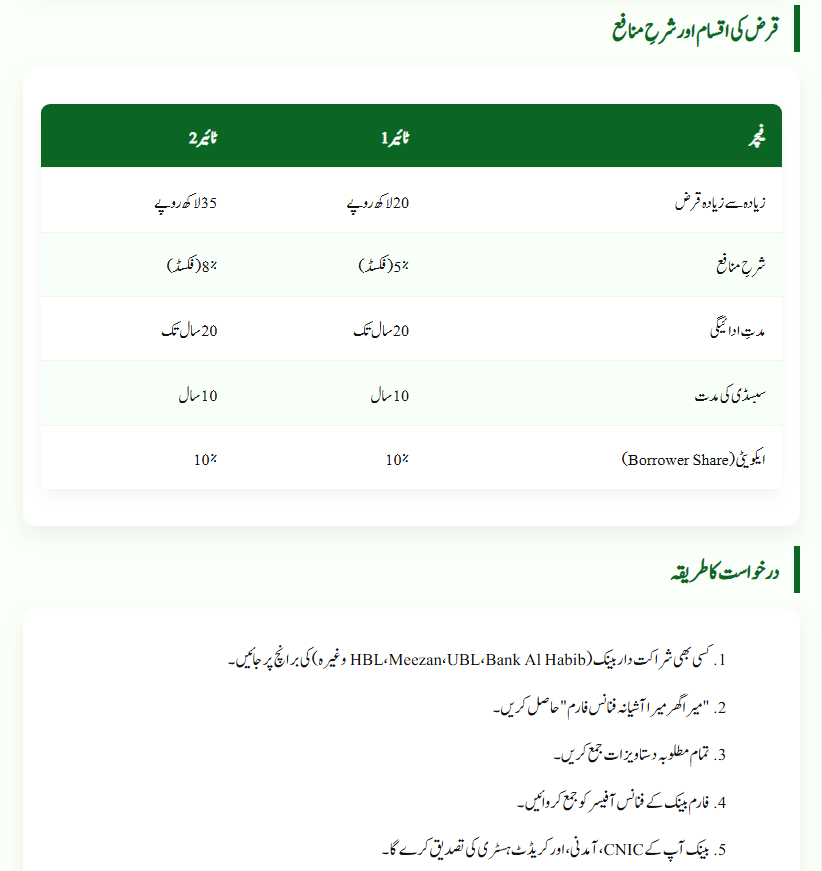

SBP Mera Ghar Mera Ashiana Scheme 2025 – Loan Tiers and Markup Rates

| Feature | Tier 1 | Tier 2 |

| Maximum Loan | PKR 2 million | PKR 3.5 million |

| Markup Rate | 5% (fixed) | 8% (fixed) |

| Loan Duration | Up to 20 years | Up to 20 years |

| Subsidy Period | 10 years | 10 years |

| Borrower Contribution | 10% | 10% |

This tiered system ensures that urban and rural middle-class families can access affordable housing finance suited to their income levels.

How to Apply for SBP Mera Ghar Mera Ashiana Scheme 2025?

Applying for the scheme is simple and transparent:

- Visit any participating bank (HBL, Meezan Bank, UBL, Bank Al Habib, etc.).

- Ask for the “Mera Ghar Mera Ashiana Housing Finance Form.”

- Attach all required documents.

- Submit the form to the housing finance officer.

- The bank will verify your CNIC, income, and credit record.

- Once approved, funds will be released in stages according to the progress of construction or purchase.

Pro Tip: Apply directly through banks — avoid agents or intermediaries.

Read Also: Gold Price in Pakistan Market 8 October 2025

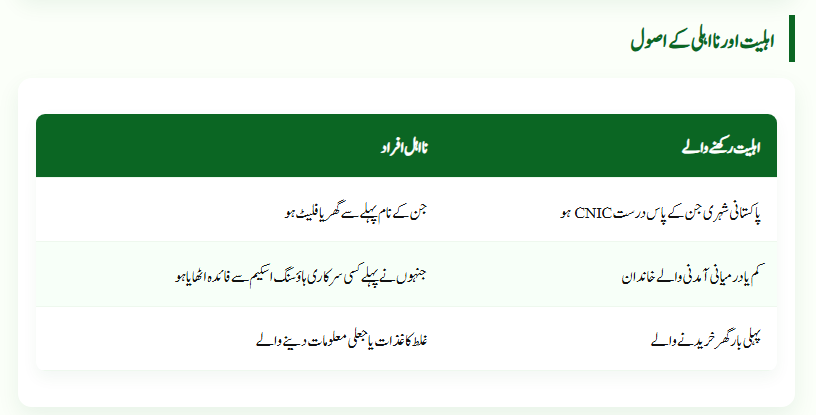

Who Is Eligible and Who Isn’t for Mera Ghar Mera Ashiana Scheme 2025?

| Eligible Applicants | Ineligible Applicants |

| Pakistani citizens with a valid CNIC | Individuals who already own a house or flat |

| Low or middle-income families | People who have benefited from previous government housing programs |

| First-time home buyers | Applicants submitting false documents or income proof |

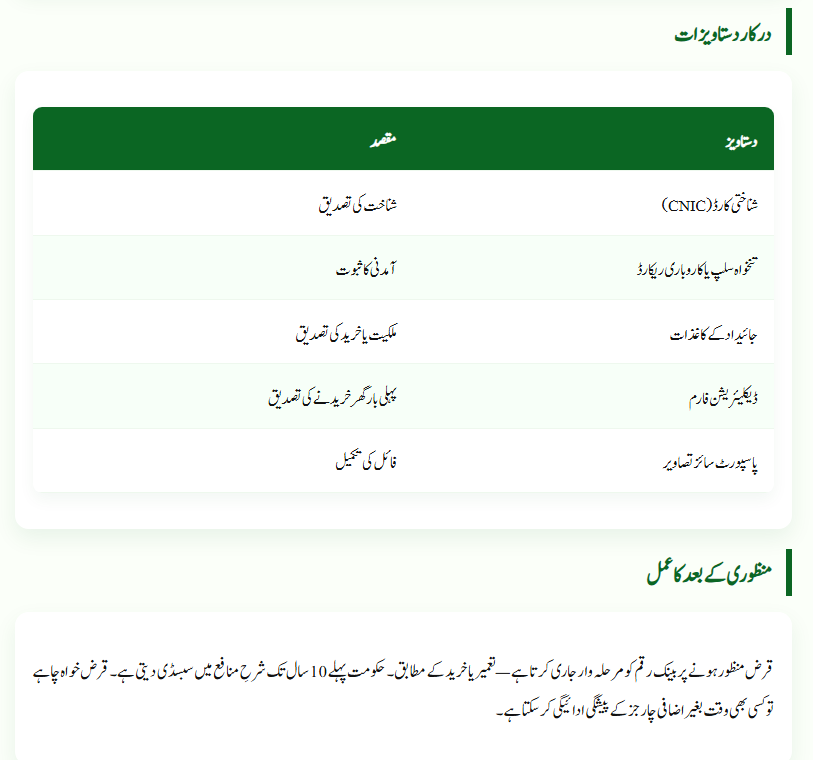

Documents Required for Mera Ghar Mera Ashiana Scheme 2025

| Document | Purpose |

| CNIC | Identity verification |

| Salary slip or business record | Proof of income |

| Property or plot papers | Proof of ownership or purchase |

| Declaration form | To confirm first-time home buyer status |

| Passport-size photos | For application file completion |

Keep copies (both physical and digital) of all documents for easy verification.

What Happens After Loan Approval in Mera Ghar Mera Ashiana Scheme 2025?

After your loan is approved, the bank disburses the funds in stages based on construction progress or property purchase. Monthly repayments begin after the first disbursement. The government pays part of your markup for the first 10 years, easing the burden on borrowers. You can repay your loan early without any penalties — giving you full financial flexibility.

Read Also: ATM Cash Withdrawal Tax Pakistan 2025: New Rate

Common Mistakes to Avoid in SBP Mera Ghar Mera Ashiana Scheme 2025

- Relying on unauthorized agents.

- Submitting incomplete or incorrect forms.

- Providing false income details.

- Applying for properties larger than the allowed limit.

- Ignoring bank messages or calls during verification.

Avoiding these mistakes helps ensure quick approval and smooth processing.

Tips for Success in SBP Mera Ghar Mera Ashiana Scheme 2025

- Maintain at least 6 months of consistent income records.

- Keep your bank statement clean and stable.

- Apply only for registered, legal properties.

- Track your application through your bank or the SBP Housing Finance Helpdesk.

These steps can significantly increase your chances of fast approval.

Why SBP Mera Ghar Mera Ashiana Scheme 2025 Matters for Pakistani Families

This program is more than just a housing loan — it’s a long-term investment in Pakistan’s future.

By helping tenants become homeowners, the government is promoting economic stability, family security, and asset building.

It also supports the construction industry, creating jobs and boosting local economies.

For many families, this is the first real opportunity to break free from rent and build a permanent home of their own.

Conclusion

The Mera Ghar Mera Ashiana Scheme 2025 is a game-changing initiative by the State Bank of Pakistan that empowers citizens to own homes through low markup loans, transparent procedures, and flexible repayment options. If sustained and monitored effectively, this scheme can transform millions of lives — turning the dream of “Apna Ghar” into reality for Pakistan’s working class.

FAQs

Q1: Who can apply for the Mera Ghar Mera Ashiana Scheme 2025?

Any Pakistani citizen with a valid CNIC who does not already own a house or flat.

Q2: What is the maximum loan amount under this scheme?

You can get up to PKR 3.5 million, depending on your income and selected tier.

Q3: What are the markup rates and duration?

Tier 1: 5% fixed, Tier 2: 8% fixed for up to 20 years with a 10-year subsidy.

Q4: Are there any hidden charges or early payment penalties?

No, the scheme has no hidden fees or prepayment penalties.

Q5: How can I apply for the scheme?

Visit any SBP-partner bank (such as HBL, Meezan, UBL, or Bank Al Habib) and apply directly through their housing finance department.

Related Posts