Even a small shift in the financial world can make a big impact — and that’s exactly what happened with Soneri Bank Profit 2025.

When the bank’s 9-month report for 2025 came out, many investors and industry watchers were surprised to see a sharp 31% decline in profit.

People began asking: Is the bank facing financial pressure? Did rising costs or higher taxes cause this drop?

This decline tells a deeper story about Pakistan’s changing banking landscape and the challenges financial institutions are facing in 2025.

In this article, we’ll break down in plain language why Soneri Bank’s profit fell, what the numbers really mean, and what the future might hold.

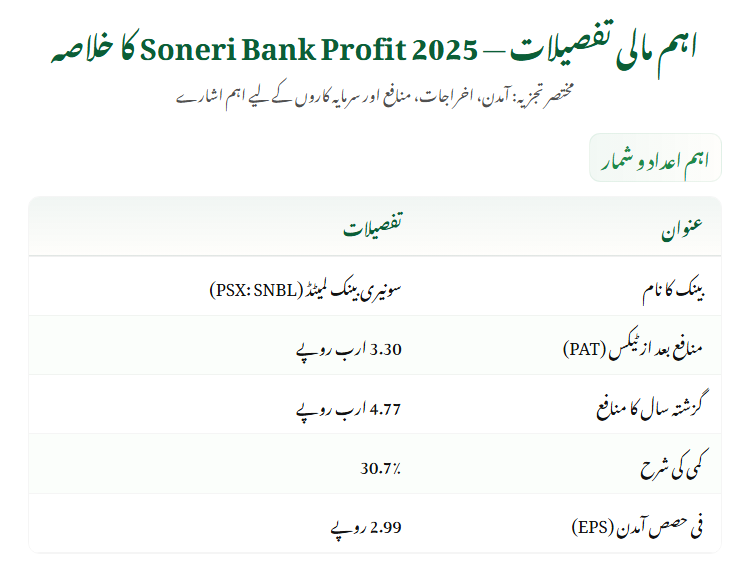

Quick Financial Summary — Soneri Bank Profit 2025 at a Glance

| Key Detail | Figure |

|---|---|

| Bank Name | Soneri Bank Limited (PSX: SNBL) |

| Profit After Tax (PAT) | Rs 3.30 billion |

| Last Year’s Profit | Rs 4.77 billion |

| Year-over-Year Decline | 30.7% |

| Earnings Per Share (EPS) | Rs 2.99 |

Did Soneri Bank Profit 2025 Really Fall This Much?

Yes. According to the official financial statement for the nine months ending September 2025, Soneri Bank’s net profit dropped from Rs 4.77 billion to Rs 3.30 billion, marking a 30.7% decline.

Earnings per share (EPS) also fell from Rs 4.32 to Rs 2.99.

Interestingly, overall income actually grew — but rising operational costs and higher taxation wiped out much of that gain.

This trend isn’t unique to Soneri Bank — several Pakistani banks faced similar financial challenges this year due to inflation, high interest rates, and tax adjustments.

Income Up but Profit Down — Why Did This Happen?

At first glance, it may seem confusing that Soneri Bank Profit 2025 fell even though income rose.

Here’s why:

- Total income increased by 14.4% to Rs 27.52 billion.

- But operating expenses jumped 21% to Rs 17.28 billion.

- Non-markup expenses rose by 22.8% to Rs 17.83 billion.

- Tax payments increased by 26.9% to Rs 6.30 billion.

So, even though business activities expanded, the rising cost structure and higher taxes reduced the bottom line significantly.

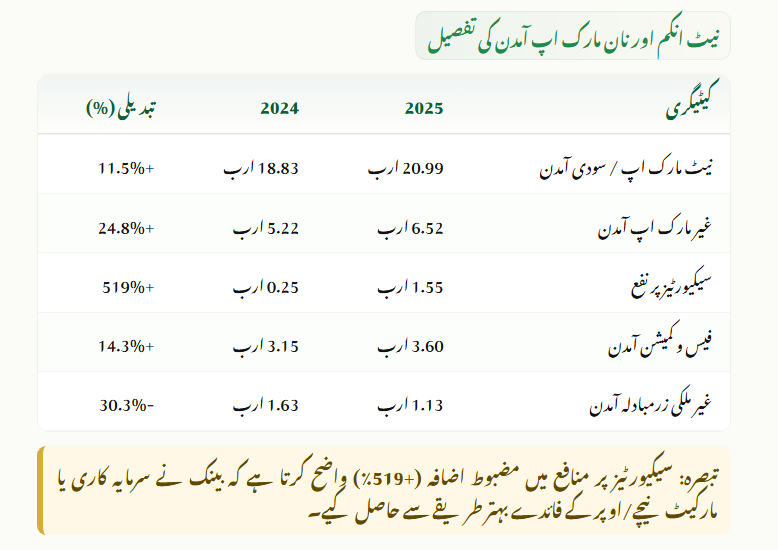

Detailed Breakdown of Soneri Bank Profit 2025 Figures

| Category | 9M 2025 | 9M 2024 | Change (%) |

|---|---|---|---|

| Net Markup / Interest Income | Rs 20.99bn | Rs 18.83bn | +11.5% |

| Non-Markup Income | Rs 6.52bn | Rs 5.22bn | +24.8% |

| Gain on Securities | Rs 1.55bn | Rs 0.25bn | +519% |

| Fee & Commission Income | Rs 3.60bn | Rs 3.15bn | +14.3% |

| Foreign Exchange Income | Rs 1.13bn | Rs 1.63bn | -30.3% |

This table shows that while income from investments and services improved, foreign exchange earnings took a major hit due to volatility in currency markets.

Are Rising Expenses Hurting Soneri Bank Profit 2025?

Yes, the biggest challenge for the bank has been increasing administrative and operational expenses.

Soneri Bank invested heavily in technology upgrades, branch network expansion, and digital infrastructure — all essential but costly initiatives.

The short-term impact of these investments is higher expenses, but the long-term goal is improved efficiency and profitability.

Additional costs such as Workers’ Welfare Fund contributions and other charges also increased, bringing the Profit Before Tax (PBT) down slightly by 1.3% to Rs 9.60 billion.

What Should Investors Know About Soneri Bank Profit 2025?

For investors, this report delivers a mixed message.

Yes, the profit fell — but some underlying indicators are actually encouraging:

- Non-markup income (like fees and investment gains) jumped 24%.

- Gains on securities rose more than 500%.

- The bank maintained stable net interest margins despite tough market conditions.

Soneri Bank’s diversified income sources show that it’s not entirely dependent on traditional lending, which makes it more resilient in the long run.

Is There Hope Ahead for Soneri Bank Profit 2025 and Beyond?

Experts believe the current decline is temporary.

As inflation and interest rates in Pakistan begin to stabilize, banks could see a rebound in profitability in the coming quarters.

Soneri Bank’s strategic push in digital banking, SME financing, and corporate services positions it well for future growth.

The bank also maintains a solid balance sheet and a transparent governance structure, both of which strengthen investor confidence.

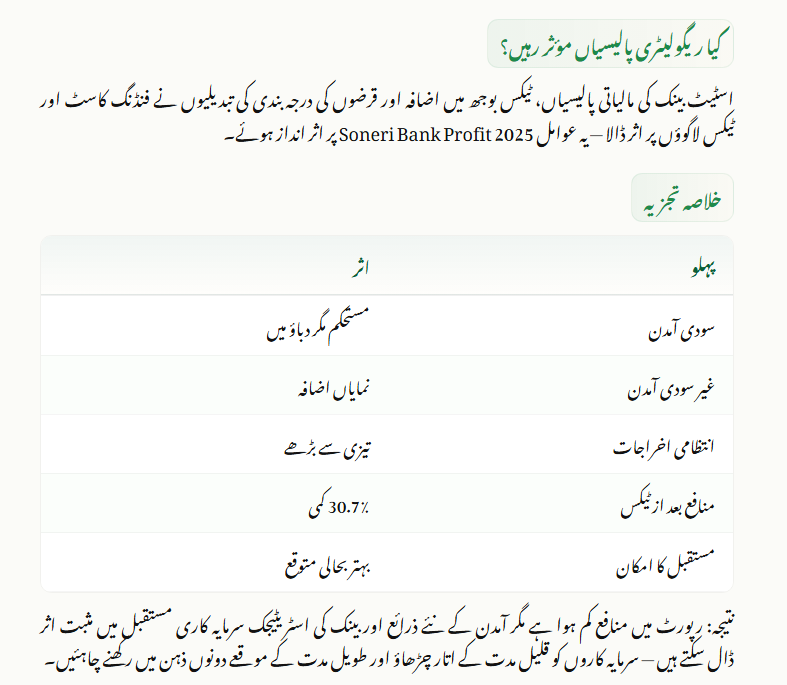

Did Government or Policy Changes Affect Soneri Bank Profit 2025?

Yes, external factors played a big role.

The State Bank of Pakistan’s high policy rate kept funding costs elevated, which squeezed profit margins.

In addition, higher taxes and changes in lending brackets further pressured net earnings.

These policy decisions, while aimed at macroeconomic stability, have short-term downsides for the banking sector — including Soneri Bank.

Summary Analysis of Soneri Bank Profit 2025

| Factor | Impact |

|---|---|

| Interest Income | Stable but pressured |

| Non-Interest Income | Strong growth |

| Operating Costs | Sharp increase |

| Net Profit | Down 30.7% YoY |

| Future Outlook | Gradual recovery expected |

Conclusion — Soneri Bank Profit 2025 Faces Temporary Decline but Long-Term Strength Remains

In summary, the 31% drop in Soneri Bank Profit 2025 reflects short-term market pressures rather than a structural weakness.

The bank’s solid income base, improved diversification, and focus on technology suggest it is building for long-term stability.

While investors might be concerned about the decline, the underlying fundamentals remain strong — and recovery could begin as soon as economic conditions improve.

For now, Soneri Bank remains a stable and forward-looking institution, adapting to a challenging environment with strategic discipline.

For more details, visit the official website:

👉 https://www.soneribank.com

FAQs About Soneri Bank Profit 2025

1. Why did Soneri Bank Profit 2025 fall by 31%?

The drop mainly occurred due to higher administrative costs, increased taxation, and reduced foreign exchange income despite overall revenue growth.

2. Did Soneri Bank still increase its total income in 2025?

Yes. Total income rose 14.4% year-on-year to Rs 27.52 billion, driven by higher non-markup income and stronger interest margins.

3. How did gains on securities impact Soneri Bank Profit 2025?

Gains on securities jumped over 519%, significantly supporting the bank’s total income despite rising costs.

4. Is Soneri Bank’s profit decline permanent?

No. Financial experts consider it temporary. As economic conditions stabilize, profits are expected to improve in the coming quarters.

5. Should investors be worried about Soneri Bank’s performance?

Not necessarily. The bank remains financially strong, with diversified income sources and ongoing investment in digital and SME banking that signal long-term growth potential.

Related Posts