UBL Ameen Housing Finance

Possessing a home is everyone’s basic need and main dream. To make cover reasonable for Pakistanis, the Management of Pakistan hurled the “Mera Pakistan Mera Ghar (MPMG)” scheme. Under this program, several banks are providing home financing facilities.

United Bank Limited (UBL) is one of them, offering UBL Ameen Housing Finance through its Islamic Banking division. This scheme is completely Shariah-compliant and is ideal for persons who want to buy or shape their dream home below Islamic values.

Quick Information Table

| Program Name | Start Date | End Date | Amount / Assistance | Application Method |

|---|---|---|---|---|

| UBL Ameen Housing Finance (Mera Pakistan Mera Ghar) | Active (2025) | Ongoing | Subsidized Markup: Tier-1 = 2% for 5 years, Tier-2 = 5%, Tier-3 = 7% | Online & Offline |

| UBL Ameen Address (General Housing Finance) | Active | No End Date | Based on KIBOR + 3.5% | Apply at UBL Ameen Islamic Branch or Online |

What is UBL Ameen Housing Finance?

UBL Ameen Housing Money is an Islamic home financing product that allows clienteles to buy, build, or renew their homes without paying interest (Riba).

It works on the Diminishing Musharakah model — a Shariah-compliant system wherever the bank besides the customer jointly own the property. Over time, the customer purchases the set’s share through once-a-month expenditures.

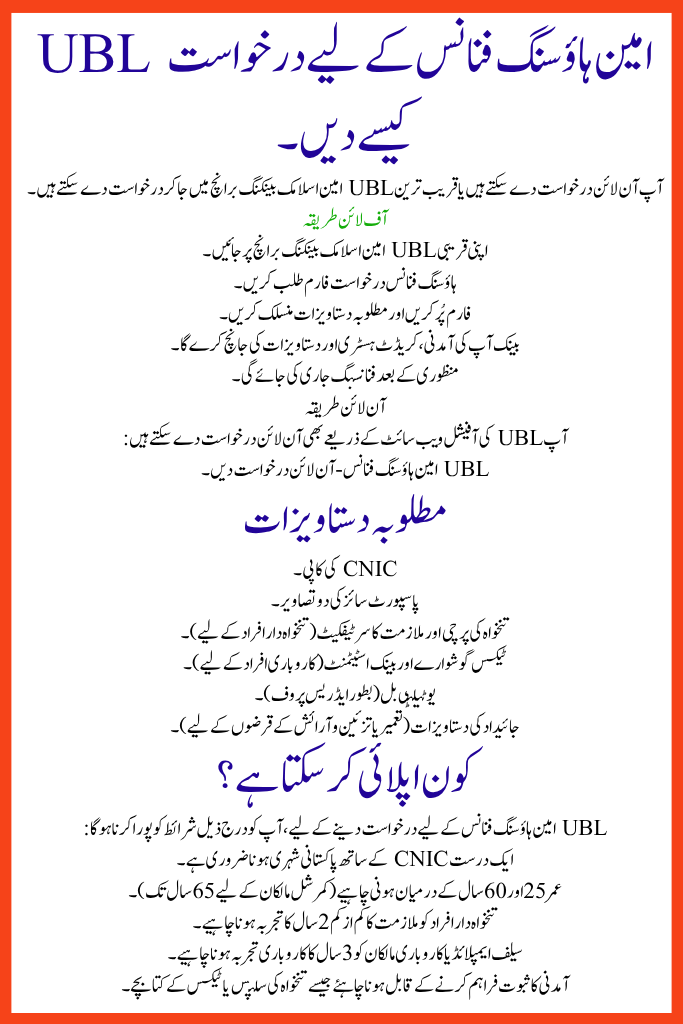

Who Can Apply?

To apply for UBL Ameen Housing Money, you must meet the following conditions:

- Must be a Pakistani citizen with a valid CNIC.

- Age should be between 25 and 60 years (up to 65 for commercial owners).

- Salaried individuals must have at least 2 years of job experience.

- Self-employed or business owners must have 3 years of business experience.

- Must be able to deliver income proof such as pay slips or tax leaflets.

Purpose of Financing

UBL Ameen Housing Money offers funds for multiple housing needs, including:

- Buying a new or used house.

- Constructing a house on your own plot.

- Renovating or extending your existing home.

This makes it a one-stop housing solution for everyone.

Loan Amount and Tenure

- Minimum loan: PKR 500,000

- Maximum loan: PKR 20 million (2 crore)

- Loan tenure: 5 to 20 years (based on customer favorite and pay).

- Installments are set according to your income level.

- Low-income clienteles can get government subsidy under MPMG.

How to Apply for UBL Ameen Housing Finance

You can apply online or by visiting the nearest UBL Ameen Islamic Banking branch.

Offline Method

- Visit your nearest UBL Ameen Islamic Banking branch.

- Ask for the Housing Finance Application Form.

- Fill out the form and attach required documents.

- The bank will check your income, credit history, and documents.

- After approval, financing will be issued.

Online Method

You can also apply online through the official UBL website:

UBL Ameen Housing Finance – Apply Online

Required Documents

- Copy of CNIC.

- Two passport-size photos.

- Salary slip and employment certificate (for salaried individuals).

- Tax returns and bank statements (for businesspersons).

- Utility bill (as address proof).

- Property documents (for construction or renovation loans).

Benefits of UBL Ameen Housing Finance

- 100% Shariah-compliant (Interest-free Islamic scheme).

- Affordable markup rates and easy monthly payments.

- Flexible repayment tenure (5 to 20 years).

- Financing available for purchase, construction, and renovation under one arrangement.

- Available nationwide through UBL Ameen branches.

- Government subsidy available for low-income relations.

Mera Pakistan Mera Ghar (MPMG) – Subsidized Housing Scheme

Under this government-supported package, UBL Ameen offers home backing on low and backed rates for low to middle-income persons.

| Tier | House Size | Max Price | Max Loan Amount | Subsidized Markup |

|---|---|---|---|---|

| Tier 1 (NAPHDA Projects) | Up to 5 Marla / 850 sq. ft | PKR 3.5 million | PKR 2.7 million | 2% for first 5 years |

| Tier 2 | Up to 5 Marla / 1250 sq. ft | Market-based | PKR 6 million | 5% first 5 years, 7% next 5 years |

| Tier 3 | Up to 10 Marla / 2000 sq. ft | Market-based | PKR 10 million | 7% first 5 years, 9% next 5 years |

Key Points to Remember

- The scheme is still active in 2025, but government policies may change.

- Eligibility and subsidy rates can vary based on income, location, and property value.

- After the subsidized period ends, regular market rate (based on KIBOR) applies.

- Always check latest updates from UBL or the State Bank of Pakistan (SBP) before applying.

Conclusion

UBL Ameen Housing Money is a safe, transparent, and Islamic home help option for Pakistanis who wish to fulfill their dream of possessing a home.

Whether you want to buy, build, or renovate, UBL Ameen offers easy installments, flexible terms, and Shariah-compliant financing — making it one of the most dependable options in Pakistan.

If you are groundwork to get your dream home, visit your nearest UBL Ameen Islamic branch or apply connected today to check your aptness and backing interests.

Related Posts